Another 4 years

in the White House

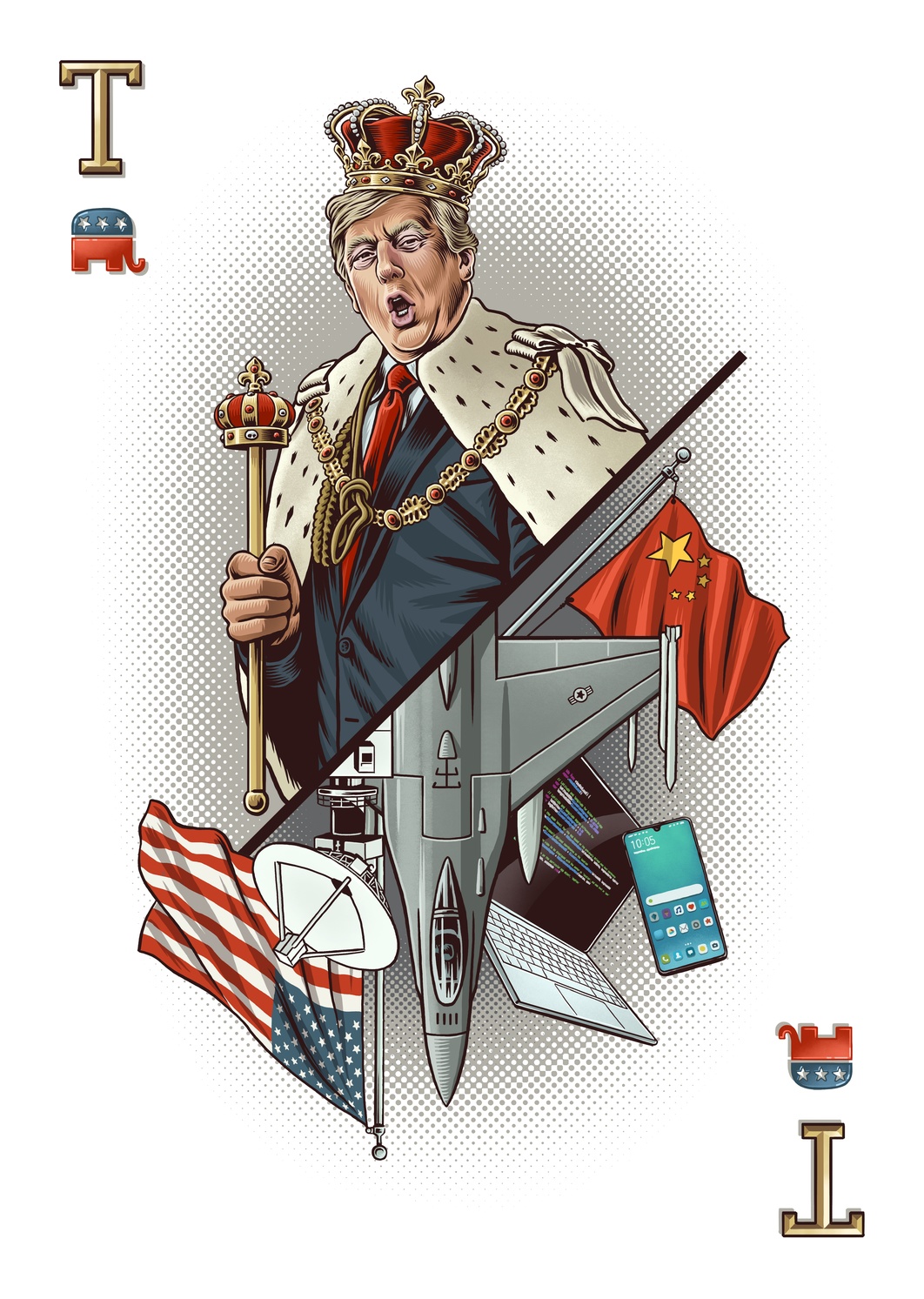

America has voted! Against all the odds and in spite of his opponents’ harsh criticism, Donald Trump was able to maintain the trust of his supporters and will be running the office of President of the United States for the next four years. Traders, be prepared for high market tides in the coming hours and days!

Want to get ahead of the curve?

Subscribe to our Swissquote Bank's Newsletter to receive market news, trade ideas & new themes

Investing made simple

_

Looking to invest in a sector you care about, but don’t have the time, knowledge or funds to build and maintain a full portfolio?

Trade a balanced selection of stocks in a single click with Swissquote Themes Trading Certificates. Based on a portfolio of stocks tied to a specific theme or industry sector, they are handpicked and constantly optimized by our experts.

Trading

3 million reasons to be ambitious.

Your portfolio on the most sought-after platform in Switzerland

- 3 million products on 60 stock exchanges

- Competitive pricing starting from 9.-

Forex

Trade Forex with Swiss excellence.

Trade more than 130 instruments FX & CFDs

- 3 cutting-edge platforms: Advanced Trader, MT4 & MT5

- Premium plugins & tools to find the best trading ideas

Take advantage of our special offer

_

Until 31 December 2020, Swissquote will not charge you third-party fees for deposits paid into Swissquote accounts using a credit card.

2020 has warped our perception of time.

We’ve already experienced a pandemic, a stock market crash, economic shutdown, and potentially, a new bull market. It’s possible that things get even crazier with the upcoming election.

Currently, former Vice-President Biden has a commanding lead in the polls. According to the RealClear Politics average of polls, Biden is ahead by 7.6 points.

Biden has a similar lead in many key swing states like Michigan, Pennsylvania, and Wisconsin. This year, there’s less undecided voters. And, historically undecided voters tend to break for the challenger which also favors Biden.

This is leading to increasing confidence that Biden is going to glide to a victory. Yet, it’s natural to be skeptical about this consensus given what happened in 2016. At this point in the race, Hillary Clinton was leading 47% to 41.3%. Trump shocked the world and eked out a slim victory by carrying swing states.

Additionally, there’s still plenty of time before the election. Trump could make a comeback or Biden’s lead could turn into a landslide. Here are six potential wildcards that could change the election dynamic:

Economic Recovery Continues

_

In hindsight, it’s clear that the stock market bottomed in late-March, and the economy seems to have bottomed in mid-April. Economic data continues to show a recovery from low levels, in the most affected areas. It’s quite clear from high-frequency data in multiple areas like online job postings, TSA travel data, and credit-card spending.

The housing market is also very strong. This leads to more economic confidence, stronger household balance sheets, and is positive for blue-collar workers. Additionally, forward-looking indicators like the stock market and commodity prices have also recovered and are above their pre-coronavirus levels.

In recent weeks, the polls have tightened on the margins, and it could be due to the improving economy and surging stock market. If these trends continue, it could lead to Trump’s support increasing.

A Vaccine Becomes Available

_

If a safe vaccine became available, it could be a gamechanger and lead to life quickly returning to normal. It would reinvigorate areas of the economy like airlines, hotels, restaurants, and nightlife that are running on fumes.

Trump’s biggest liability is his handling of the coronavirus. However, a vaccine would change the narrative, accelerate the recovery, lead to another leg higher for the stock market, and improve Trump’s odds of winning.

Biden Stumbles on Stage

_

Another potential surprise could be at the debates. Trump’s campaign has made an issue out of Biden’s age and have attacked his stamina and mental capacity.

At the debates, Trump will surely go on the offensive, especially if he is down in the polls. A Biden miscue would make these attacks more credible and create doubts in voters’ minds about his ability to lead the nation.

It’s also possible that Trump is setting a trap for himself by creating low expectations for Biden. During the Democratic Primaries, Biden held up fine during long debates and sparred with multiple candidates.

Protests Intensify

_

In certain cities in the US, there have been days and weeks of protesting that has gotten violent at times with clashes between protestors and police. The situation is fluid, but it traditionally benefits the law-and-order candidate. If these protests get more violent or spread to other cities, it could benefit Trump.

One example of this effect can be seen in Minnesota which saw some of the most intense protests and rioting, and the Minneapolis City Council voted to defund police. It’s led to polls tightening in Minnesota.

Coronavirus Case Counts Start Increasing

_

The coronavirus has been a part of our lives for more than six months. One lesson is that it seems to never totally go away. If there’s an increase in case counts due to schools reopening, a change in weather, or the virus mutating, it could lead to another period of economic activity being depressed. This would lead to a falling stock market and job losses which would dent Trump’s chances of making a comeback.

It would also highlight Trump’s failures in initially combating the virus such as never completely locking down in the first place or instituting a test-and-trace program to prevent future outbreaks. It would also lead to contrasts with other countries which have handled the virus much more effectively.

Voting Issues

_

Already, President Trump has started to dispute the authenticity of the vote count. He’s already said the election will be “rigged” and mail-in voting is fraudulent. Given Trump’s attacks and defunding of the US Postal Service to obstruct mail-in ballots, there is already skepticism and suspicion on the Democratic side as well that their votes won’t be fairly counted.

One of the foundational aspects of a democracy is the peaceful transfer of power. There would certainly be economic and political ramifications if this core pillar is shaken in the event that Trump loses and refuses to hand over power. Or, Trump could win and a large part of the country would think he won due to voter suppression.

Another possible wildcard is if there’s a resurgence in coronavirus case counts which prevents people from voting, It’s unclear how it would affect the election, since older people are more susceptible, and they tend to vote Republican, but Democrats tend to take the coronavirus more seriously.

The US presidential election is roughly three months away and the investor attention will somewhat shift towards what’s happening on the US political front in the lead up to the November election. In this article, we discuss how different election outcomes could impact the performance of the US stock markets.

The Covid pandemic didn’t leave much space for other talking points in the markets this year. But the US election is roughly three months away and the investor attention will somewhat shift towards what’s happening on the US political front in the lead up to the November election and how different election outcomes could impact the performance of the US stock markets.

What does the historical data tell?

_

Historical data shows that the stock market volatility tends to increase in the months leading up to an election. This is due to the political uncertainties and the continuous assessment of pole results and market expectations.

As a rule of thumb, a Republican lead is supportive of stock prices as Republicans focus on enhancing company earnings and shareholder profits, while a Democrat lead would have the opposite impact on equity prices as Democrats would concentrate on redistribution of wealth, and social rights and benefits.

Also, markets tend to perform better when the ruling president stays in office. It is, again, a matter of more certainty, and a switch from Republican to Democrat government could have a negative impact on stock prices as investors factor in business-unfriendly changes such as stricter rules, higher corporate taxes and so.

But this time, it is different.

_

The US economy has been struggling with an unprecedented recession due to a global pandemic that has ravaged all layers of businesses across the country. Donald Trump is highly criticized for his poor management of the public health crisis that resulted in the US being the worst-hit country by the pandemic worldwide.

With roughly 15 million unemployed and a skyrocketing government debt, the US economy is not out of the woods just yet, even though the V-shape correction in the US stock markets distort the perception of the underlying fundamentals and paint a drastically different picture compared to what’s really happening on the field.

Economy versus the stock market

_

Forbes magazine writes that the stock market and the economy are key indicators of who wins a presidential election, highlighting that avoiding a recession in the two years leading up to an election is a key indicator of reelection. In the past century, presidents who averted recession during this two-year period have been reelected.

Likewise, a positive performance in the S&P500 during the three months leading up to an election has been a major sign that the ruling president would be reelected and a negative performance in the S&P500 would hint at a new government taking over. According to Forbes, the S&P500’s three-month performance has predicted up to 87% of the election outcome since 1928, and 100% since 1984.

But in the past, the stock market performance has been at least a little bit in line with the underlying economic fundamentals. This is clearly not the case this year. In fact, the massive monetary and fiscal stimulus pumped a gigantic amount of liquidity into the financial markets, triggering the fastest rebound in equity prices following a bear market. Meanwhile, the real economy has been left behind the market euphoria and saw a moderate recovery only.

So if we look at the actual state of the economy, Donald Trump is in a difficult position as he has been the victim of the worst economic recession of our lifetime, and the situation will unlikely get significantly better by the time voters go to the ballots. But if we look from a stock market perspective, he is not doing too bad.

The 2020 will show what matters the most to voters: the stock market performance, or the real economy.

What could hurt the stock markets: Trump-reelection, Biden-win or a delay?

_

The election polls showed up to a two-digit advance for Joe Biden over Donald Trump, even though the latest polls hint that Biden’s lead significantly narrowed since June. But there is no sign of stress regarding the Biden-lead across the US equities. Provided the cataclysmic economic conditions, Democrats can’t do much harm to the financial markets, fearing that any weakness across equities would have broader implications for the economy. So, investors are convinced that the pandemic would somehow protect their capital gains even under a Democratic government.

On the other hand, even though a handover to a Democratic government might have an early negative reaction of some 2–3% drop in major US indices, the historical data reassures that the kneejerk sell-offs have been short-lived and the stock prices recovered the year following an election, regardless of who got elected.

Nevertheless, this time around, the US election is not necessarily about who will win the race. A Democrat win is not the major risk to the US stock prices.

The leading risk to the 2020 US election, and the equity markets, is a possible delay.

If the pandemic prevents the US voters from heading to the polls on November 3rd, voting by mail seems to be a safe option.

Yet, to win some time, Donald Trump is willing to postpone the November 3 election. In a recent tweet, the president warned ‘with the Universal Mail-In voting, 2020 will be the most inaccurate & fraudulent election in history’. But Trump doesn’t have the power to postpone the election himself, the decision should be approved by the Senate.

For now, any delay is highly unlikely, but if it happened, it could cause strong headwinds across the financial markets, as investors don’t like political disruptions, and even less uncertainties.

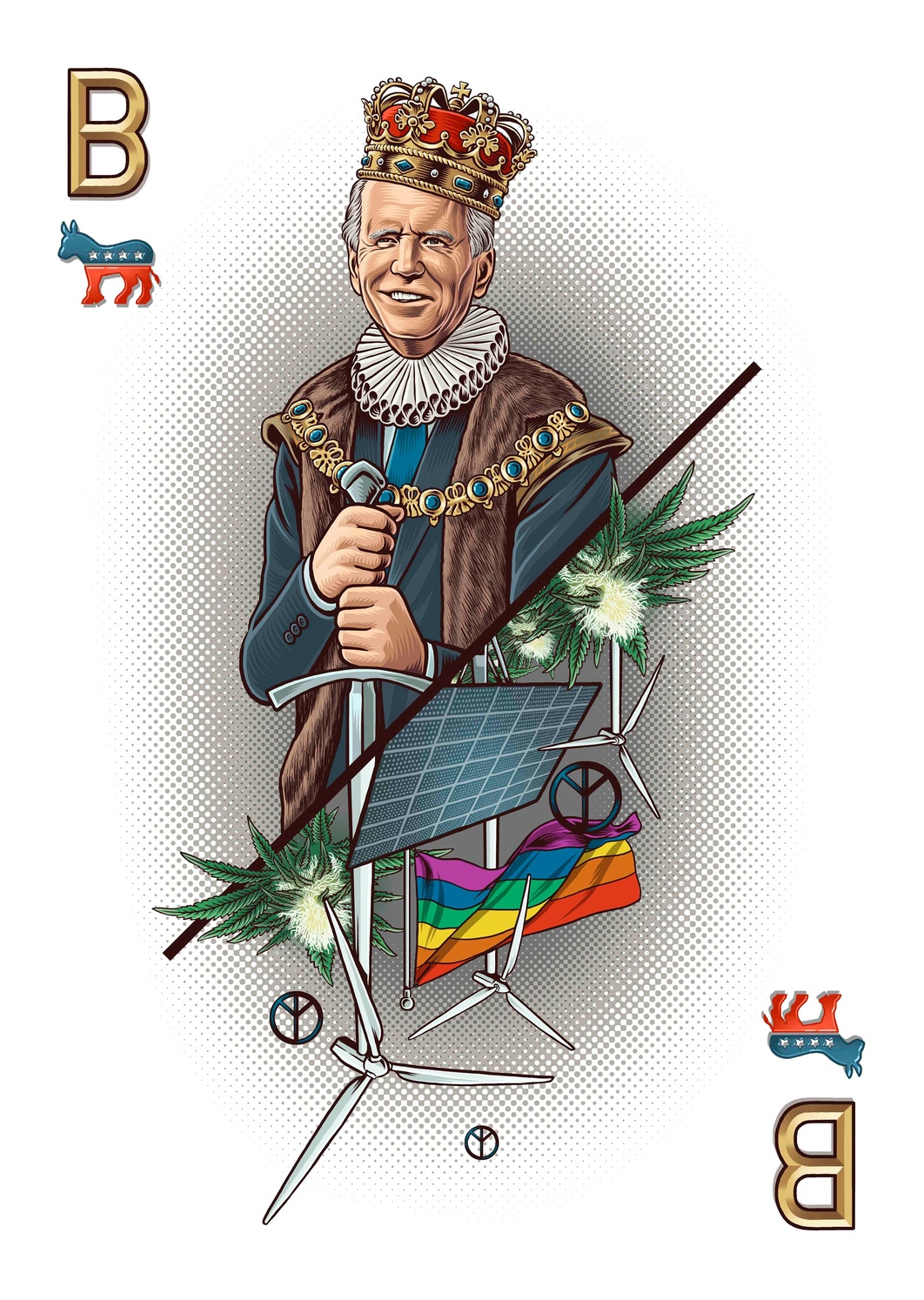

Joe Biden

Democrat

With a flawless resumé and a clean reputation, the former Vice President and Senator seems to have what it takes to do the job. Aged 77, Biden says he is going to build on Obama’s legacy and lead his country by the hand to once and for all put an end to the current crisis. We cannot help but wonder: Is Biden the man that will make Uncle Sam sleep better at night or is he just the lesser of two evils, as malicious tongues would claim?

Pro: Never said the pandemic was a hoax

Con: Recycled establishment politician

Bio

_

Joe Biden, former president Barack Obama’s vice president, is a long-time darling of moderate Democrats. The recent Democratic National Convention shone a light on his strategy: Defend democracy and welcome a wide range of Americans, including ardent Bernie Sander supporters and Republicans alike.

A career politician, Biden earned his first Senate seat at the young age of 29. He quickly became known for his foreign policy expertise. He has also been a proponent of tougher crime laws that have put a disproportionately high number of people of color behind bars in a country that houses more than 20 percent of the world’s prison population. Now, he says he’ll eliminate private prisons.

His cringe-worthy tendency to give young women unsolicited back rubs is only acceptable in that it pales in comparison to the president’s own record. But this year, “acceptable” is enough for millions of voters ready to say “Bye-Don” 2020.

Harris Bio

_

Kamala Harris breaks barriers as a Black and Indian woman running for vice president of the US. Harris came up as what she called a “progressive prosecutor” in California, though some say she’s too pro-police to be a sound choice as Black Lives Matter protests take over the nation.

6 Policies

Kanye West

Independent

Jimmy Carter was a peanut farmer, Ronald Reagan was a movie star – so why not a rapper named Kanye West this time? The independent candidate is running for president under the party “BDY”, meaning “Birthday Party”, as he considers “it’s everybody’s birthday” if he wins. Keeping up with Kanye is hard, as he changes his mind constantly but who says his election couldn’t be the surprise of the year?

Pro: Great music at the inauguration

Con: “I am a god.” – Kanye West

Bio

_

What can be said about legendary rapper/producer-turned-presidential candidate Kanye “Ye” West that he hasn’t already said himself? “I am Warhol! I am the number one most impactful artist of our generation. I am Shakespeare in the flesh. Walt Disney, Nike, Google,” Kanye said in 2013.

While his peers from The Rolling Stones to Rihanna have slapped cease and desist orders on Trump, Kanye famously donned a MAGA hat until his first campaign rally, where he showed up in a bulletproof vest with “2020” shaved in his hair.

That day, his assertion that Harriet Tubman “never actually freed the slaves, she just had them work for other white people,” and confession that he once wanted to abort his first daughter, had his wife Kim Kardashian issuing a public plea for his mental health.

So who is Kanye? If you ask him: “A god.” Ok Ye. But a president?

Michelle Tidball Bio

_

Not much is known about this Wyoming-based “biblical life coach.” The google search found some worrying results and official bio that has been removed from her site.