Joe Biden

Democrat

With a flawless resumé and a clean reputation, the former Vice President and Senator seems to have what it takes to do the job. Aged 77, Biden says he is going to build on Obama’s legacy and lead his country by the hand to once and for all put an end to the current crisis. We cannot help but wonder: Is Biden the man that will make Uncle Sam sleep better at night or is he just the lesser of two evils, as malicious tongues would claim?

Pro: Never said the pandemic was a hoax

Con: Recycled establishment politician

Bio

_

Joe Biden, former president Barack Obama’s vice president, is a long-time darling of moderate Democrats. The recent Democratic National Convention shone a light on his strategy: Defend democracy and welcome a wide range of Americans, including ardent Bernie Sander supporters and Republicans alike.

A career politician, Biden earned his first Senate seat at the young age of 29. He quickly became known for his foreign policy expertise. He has also been a proponent of tougher crime laws that have put a disproportionately high number of people of color behind bars in a country that houses more than 20 percent of the world’s prison population. Now, he says he’ll eliminate private prisons.

His cringe-worthy tendency to give young women unsolicited back rubs is only acceptable in that it pales in comparison to the president’s own record. But this year, “acceptable” is enough for millions of voters ready to say “Bye-Don” 2020.

Harris Bio

_

Kamala Harris breaks barriers as a Black and Indian woman running for vice president of the US. Harris came up as what she called a “progressive prosecutor” in California, though some say she’s too pro-police to be a sound choice as Black Lives Matter protests take over the nation.

6 Policies

Kanye West

Independent

Jimmy Carter was a peanut farmer, Ronald Reagan was a movie star – so why not a rapper named Kanye West this time? The independent candidate is running for president under the party “BDY”, meaning “Birthday Party”, as he considers “it’s everybody’s birthday” if he wins. Keeping up with Kanye is hard, as he changes his mind constantly but who says his election couldn’t be the surprise of the year?

Pro: Great music at the inauguration

Con: “I am a god.” – Kanye West

Bio

_

What can be said about legendary rapper/producer-turned-presidential candidate Kanye “Ye” West that he hasn’t already said himself? “I am Warhol! I am the number one most impactful artist of our generation. I am Shakespeare in the flesh. Walt Disney, Nike, Google,” Kanye said in 2013.

While his peers from The Rolling Stones to Rihanna have slapped cease and desist orders on Trump, Kanye famously donned a MAGA hat until his first campaign rally, where he showed up in a bulletproof vest with “2020” shaved in his hair.

That day, his assertion that Harriet Tubman “never actually freed the slaves, she just had them work for other white people,” and confession that he once wanted to abort his first daughter, had his wife Kim Kardashian issuing a public plea for his mental health.

So who is Kanye? If you ask him: “A god.” Ok Ye. But a president?

Michelle Tidball Bio

_

Not much is known about this Wyoming-based “biblical life coach.” The google search found some worrying results and official bio that has been removed from her site.

6 Policies

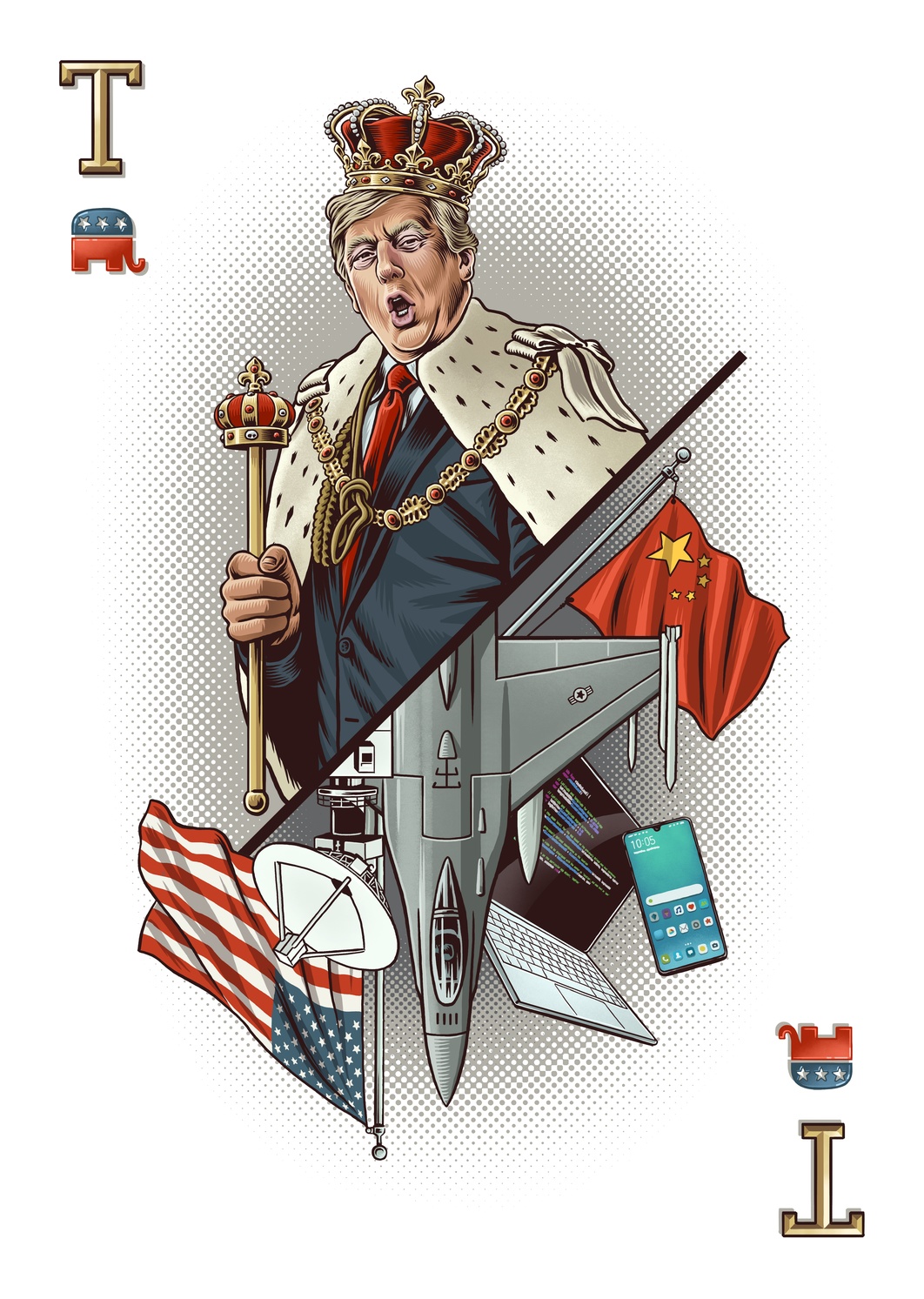

Donald Trump

Republican

Hair on fleek, perfect teeth, enthusiastic Twitter user – this is how Donald Trump is engraved in the world’s memory. His election as President of the United States in 2016 made (positive and negative) waves that have an impact until this day but Trump is unswervingly standing on his throne with his head up high – maybe a bit like the musicians on the sinking Titanic? Or is Trump rather the “unsinkable” kind of ship?

Pro: A soaring stock market

Con: Have you seen his Twitter?

Bio

_

You may have heard of this reality TV star, 45th president of the United States and reason Twitter had to start fact checking. Donald J. Trump, who announced his 2016 presidential bid with a promise to build a border wall (he hasn’t) and have Mexico pay for it (they haven’t), has been proud of his “zero tolerance” immigration policy.

But Trump’s favorite talking point? A booming economy (that has been steadily expanding for the last 11 years). But with 2020, came Trump’s biggest foe. Not Biden. Not Impeachment. An economy-threatening pandemic that’s killed 200,000 Americans and counting.

In true Trump fashion, the 2020 election will be great reality TV, with possible appearances by Trump’s unnamed national police and his potential refusal to concede the election if he loses. That only applies if you take Trump at his word. We’ll see if voters do, this November.

Mike Pence Bio

_

Trump’s vice president, Mike Pence describes himself as “a Christian, a conservative and a Republican, in that order.” His faithful marriage to one woman and fierce opposition to abortion and LGBTQA rights helped Trump secure the Evangelical vote. Now he’s in charge of Space Force. What’s that? No one knows.

6 Policies

Symbol | Minimum spread | Margin | Min. | Max. | ||

|---|---|---|---|---|---|---|

Standard | Premium | Prime | ||||

EURUSD | 1.7 | 1.4 | 1.1 | 1% | 0.01 | 200 |

USDJPY | 1.6 | 1.4 | 1.2 | 1% | 0.01 | 100 |

GBPUSD | 2.0 | 1.7 | 1.4 | 1% | 0.01 | 100 |

USDCHF | 2.0 | 1.8 | 1.6 | 1% | 0.01 | 100 |

EURCHF | 2.4 | 2.2 | 1.9 | 1% | 0.01 | 50 |

EURGBP | 1.7 | 1.5 | 1.2 | 1% | 0.01 | 50 |

USDCAD | 2.7 | 2.4 | 2.2 | 1% | 0.01 | 100 |

AUDUSD | 1.6 | 1.4 | 1.2 | 1% | 0.01 | 100 |

NZDUSD | 2.3 | 2.2 | 1.8 | 1% | 0.01 | 50 |

USDCNH | 16.4 | 14.4 | 10.2 | 4% | 0.01 | 50 |

USDMXN | 39.2 | 29.2 | 19.2 | 4% | 0.01 | 50 |

USDRUB | 130.5 | 90.5 | 50.5 | 4% | 0.01 | 50 |

XAUUSD | 0.29 | 0.26 | 0.23 | 4% | 0.01 | 100 |

#US500 | 1.15 | 0.85 | 0.65 | 2% | 1 | 200 |

#NAS100 | 2.20 | 1.90 | 1.70 | 2% | 1 | 200 |

#US30 | 3.70 | 3.40 | 3.20 | 2% | 1 | 200 |

#DE30 | 2.50 | 2.20 | 2.00 | 2% | 1 | 200 |

OIL100 | 0.05 | 0.04 | 0.03 | 2% | 0.01 | 100 |

STANDARD

SPREADS

FROM 1.7 PIPS

—

ZERO

COMMISSIONS

MINIMUM DEPOSIT (IN USD)

1'000

MOST POPULAR

PREMIUM

SPREADS

FROM 1.4 PIPS

—

ZERO

COMMISSIONS

MINIMUM DEPOSIT (IN USD)

10'000

PRIME

SPREADS

FROM 1.1 PIPS

—

ZERO

COMMISSIONS

MINIMUM DEPOSIT (IN USD)

50'000

PROFESSIONAL

CUSTOM

SPREADS

—

BESPOKE

PRICING

MINIMUM DEPOSIT (IN USD)

Volume based

A stimulus to the digital economy